Some Known Incorrect Statements About Amur Capital Management Corporation

Some Known Incorrect Statements About Amur Capital Management Corporation

Blog Article

What Does Amur Capital Management Corporation Do?

Table of ContentsAll about Amur Capital Management CorporationAmur Capital Management Corporation for DummiesAmur Capital Management Corporation Things To Know Before You Get ThisSome Known Incorrect Statements About Amur Capital Management Corporation Our Amur Capital Management Corporation IdeasThe Best Strategy To Use For Amur Capital Management Corporation

This makes actual estate a rewarding long-lasting investment. Actual estate investing is not the only method to spend.

Amur Capital Management Corporation - Questions

Savvy investors may be compensated in the type of appreciation and rewards. Actually, because 1945, the average large supply has returned near 10 percent a year. Stocks really can work as a long-term savings car. That claimed, stocks could just as quickly diminish. They are by no implies a safe bet.

That said, real estate is the polar opposite pertaining to certain facets. Net profits in genuine estate are reflective of your very own actions.

Stocks and bonds, while often abided together, are essentially different from one an additional. Unlike stocks, bonds are not agent of a stake in a firm.

The Facts About Amur Capital Management Corporation Uncovered

The genuine advantage property holds over bonds is the time structure for holding the financial investments and the price of return during that time. Bonds pay a fixed interest rate over the life of the financial investment, hence purchasing power keeping that passion goes down with inflation over time (investing for beginners in copyright). Rental building, on the various other hand, can produce higher rental fees in periods of higher rising cost of living

It is as simple as that. There will certainly constantly be a need for the rare-earth element, as "Fifty percent of the globe's population relies on gold," according to Chris Hyzy, chief financial investment officer at U.S. Depend on, the personal wide range monitoring arm of Financial institution of America in New York. According to the World Gold Council, need softened in 2014.

The Ultimate Guide To Amur Capital Management Corporation

Consequently, gold costs should come back down to earth. This must bring in inventors seeking to profit from the ground degree. Acknowledged as a relatively secure asset, gold has actually developed itself as a lorry to increase browse around this site investment returns. However, some don't even think about gold to be an investment whatsoever, rather a hedge against rising cost of living.

Certainly, as safe as gold may be thought about, it still fails to stay as attractive as actual estate. Right here are a couple of reasons financiers like realty over gold: Unlike property, there is no funding and, as a result, no area to take advantage of for development. Unlike property, gold recommends no tax benefits.

Amur Capital Management Corporation - Questions

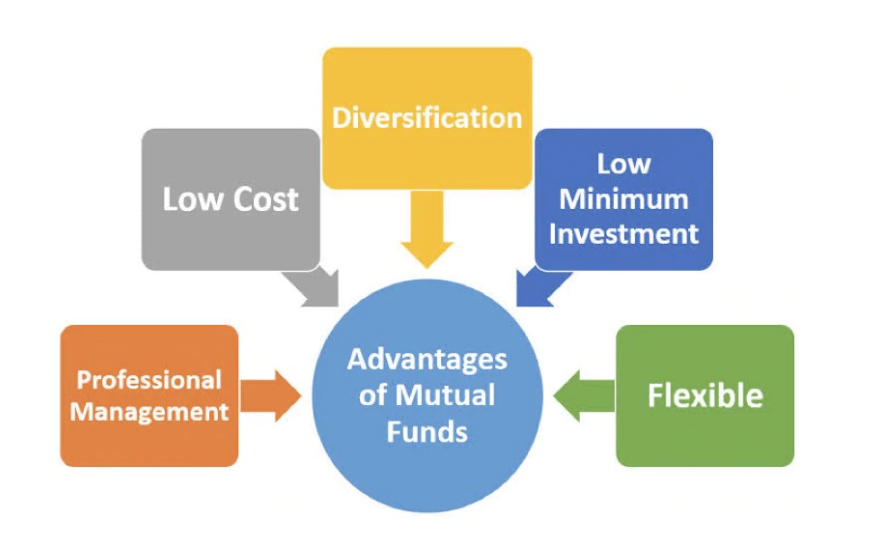

When the CD develops, you can collect the initial investment, in addition to some passion. Deposit slips do not appreciate, and they've had a historic average return of 2.84 percent in the last eleven years. Property, on the various other hand, can value. As their names suggest, common funds include financial resources that have been pooled with each other (alternative investment).

It is one of the simplest means to branch out any portfolio. A common fund's performance is constantly measured in terms of complete return, or the sum of the adjustment in a fund's internet asset worth (NAV), its returns, and its resources gains circulations over a provided period of time. However, similar to supplies, you have little control over the performance of your properties. https://amurcapitalmanagementcorporati.godaddysites.com/f/the-ultimate-guide-to-mortgage-investment-corporations.

Putting cash into a shared fund is basically handing one's financial investment decisions over to a professional cash manager. While you can decide on your financial investments, you have little state over how they perform. The three most typical methods to purchase property are as adheres to: Buy And Hold Rehabilitation Wholesale With the worst component of the economic downturn behind us, markets have actually been subjected to historic gratitude prices in the last three years.

The 5-Minute Rule for Amur Capital Management Corporation

Buying low does not imply what it made use of to, and financiers have actually recognized that the landscape is transforming. The spreads that dealers and rehabbers have actually ended up being familiar with are beginning to invoke up memories of 2006 when values were historically high (exempt market dealer). Obviously, there are still countless possibilities to be had in the world of flipping actual estate, however a brand-new exit strategy has become king: rental homes

Or else called buy and hold residential properties, these homes feed off today's appreciation prices and utilize on the fact that homes are extra pricey than they were just a couple of brief years back. The principle of a buy and hold leave technique is simple: Capitalists will aim to enhance their profits by leasing the residential or commercial property out and collecting month-to-month cash money circulation or merely holding the property till it can be cost a later day for a profit, obviously.

Report this page